You’ve got some extra money sitting in your account — maybe from a bonus, a tax refund, or a side hustle windfall. Now comes the big question:

Should you use that money to pay off your debt, or should you invest it instead?

It’s one of the most common — and confusing — personal finance dilemmas. Both options make sense, and both can help you build a stronger financial future. But the right choice depends on your interest rates, goals, risk tolerance, and current financial health.

In this guide, we’ll break down both sides of the debate, share real-world examples, and show you how to strike the perfect balance between growing your wealth and eliminating debt for good.

📈 Investing vs. Paying Down Debt: The Basics

Investing is all about putting your money to work — buying assets that can grow in value over time, such as:

- Stocks

- Mutual funds

- ETFs (Exchange-Traded Funds)

- Real estate

- Bonds or CDs

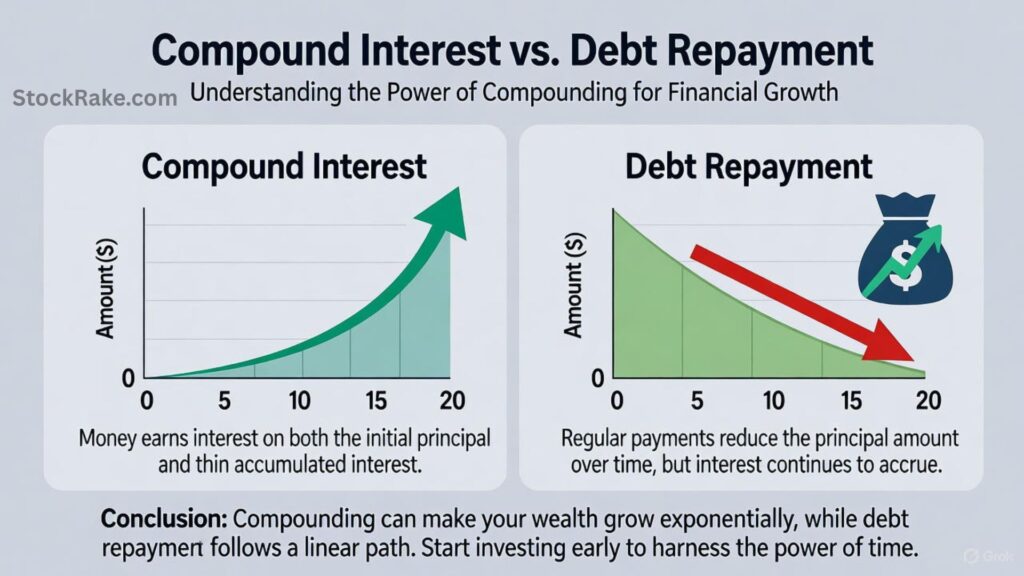

On the other hand, debt repayment is about freeing yourself from the financial weight of money you’ve already borrowed. Every month that debt sits there, it accumulates interest, eating away at your future wealth.

In short:

| Financial Move | Goal | Typical Return | Risk Level |

|---|---|---|---|

| Investing | Grow wealth over time | 5%–10% (historical average for stocks) | Moderate to high |

| Paying Off Debt | Reduce liabilities and free up cash flow | Guaranteed (equal to your interest rate) | None |

So, how do you decide which path to take first? Let’s look closer.

keep you up at night, paying off debt might be a better (and calmer) choice.

📊 Why Investing Might Make Sense

There are several situations where investing your extra money before paying off debt can be the smarter long-term move.

1. When Your Debt Has Low Interest

If your debt has a low interest rate — such as a mortgage at 4–5% or a student loan at 3–6% — you might earn more by investing than you’d save by paying down the debt early.

Example:

You have a $200,000 mortgage at 5% interest. If you instead invest $10,000 in a diversified index fund averaging 8–10% returns, your investments could grow faster than the interest you’re paying.

2. Compound Growth is Powerful

The earlier you invest, the longer your money benefits from compound interest — the “snowball effect” of earning interest on your interest.

The more time your money has to grow, the bigger your long-term payoff.

💬 “Compound interest is the eighth wonder of the world.” — Albert Einstein

Even small, consistent investments can multiply over time. For instance, $200 a month invested at a 7% annual return grows to nearly $240,000 in 30 years.

3. Employer 401(k) Match = Free Money

If your employer offers a 401(k) match, always contribute enough to get the full match before aggressively paying off low-interest debt. That match is an instant 50–100% return — something you’ll never get from paying down a 5% loan.

4. Inflation Can Work in Your Favor

In times of high inflation, the real value of your debt decreases while your investments may rise. This dynamic can make holding low-interest, long-term debt less burdensome.

⚠️ A Word of Caution

Investing isn’t guaranteed. Markets fluctuate. One year you might earn 12%, the next you could lose 8%. That’s why your risk tolerance and emotional comfort with volatility matter as much as the math.

If you lose sleep over market drops, paying off debt might feel better — even if it’s not the “optimal” financial move.

Also Read: What Are the Most Profitable Day Trading Setups?

💸 Why Paying Off Debt Might Be Smarter

In many cases, paying off debt provides the best return — especially when the debt carries high interest rates.

1. High-Interest Debt = Financial Emergency

Credit card debt is often the biggest culprit.

As of 2025, the average credit card APR exceeds 24%, according to the Federal Reserve. That means every $1,000 in credit card debt costs you $240 a year in interest — money you’re giving away for nothing.

Few investments can reliably beat that rate.

2. Paying Off Debt Improves Credit Score

Your credit utilization ratio — how much of your available credit you’re using — is a major part of your credit score. Paying off credit cards reduces that ratio, which can:

- Raise your credit score

- Lower your borrowing costs

- Improve your chances of renting, getting approved for a mortgage, or even landing a job

3. Guaranteed, Risk-Free Return

When you pay off a loan with a 10% interest rate, you’re effectively earning a guaranteed 10% return — something you can’t find in the stock market without risk.

4. Less Stress, More Freedom

Debt isn’t just financial — it’s emotional. Constant payments and growing balances can cause anxiety and limit your flexibility. Becoming debt-free brings peace of mind and freedom to make choices based on what you want, not what you owe.

Also Read: What Are Analysts’ Top Value Stock Picks This Month?

🤝 Why Not Do Both?

Here’s a little-known secret: You don’t have to choose one side.

Many financial experts recommend a hybrid approach — balancing debt repayment with investing.

Here’s a simple, practical framework:

| Step | Action | Purpose |

|---|---|---|

| 1 | Build an emergency fund (3–6 months of expenses) | Protect yourself from unexpected costs |

| 2 | Pay off high-interest debt (>8%) | Avoid interest losses |

| 3 | Start investing in tax-advantaged accounts (401(k), IRA) | Begin compounding early |

| 4 | Continue paying off remaining debt while investing regularly | Maintain balance |

Example plan:

- Use 50% of your extra cash to pay off high-interest credit cards.

- Use 25% to invest in a retirement fund or index ETF.

- Save 25% for emergencies or short-term goals.

This way, you’re improving your financial health and building wealth simultaneously.

💳 Smart Tips for Paying Off Debt Faster

If you’ve decided to focus on debt repayment, these strategies can help you do it efficiently:

1. Target High-Interest Debts First (Avalanche Method)

Pay off debts with the highest interest rates first while making minimum payments on the rest.

This minimizes total interest paid and gets you debt-free faster.

2. Try the Snowball Method

Start with the smallest debts first for quick wins and motivation. Once one is paid off, roll that payment into the next debt.

3. Consider a Balance Transfer

Many credit cards offer 0% APR balance transfers for 6–18 months. That gives you breathing room to pay down the balance faster — just watch out for transfer fees.

4. Explore Debt Consolidation Loans

Combine multiple high-interest debts into a single loan with a lower rate. This simplifies your finances and can reduce your total interest cost.

5. Automate Your Payments

Setting up auto-pay helps you stay consistent, avoid late fees, and ensure progress without constant effort.

😟 What If You’re Drowning in Debt?

If your debt feels overwhelming, don’t panic — you have options.

1. Talk to Your Lenders

Creditors would rather get paid something than nothing. Ask about:

- Lower interest rates

- Payment plans

- Hardship programs

2. Seek Professional Help

A nonprofit credit counseling agency can help you create a plan and negotiate better terms.

Beware of companies that promise to “erase” your debt overnight — many are scams.

According to the Federal Trade Commission (FTC), fraudulent debt relief firms often charge high upfront fees and fail to deliver results. Always check for accreditation through reputable organizations like the National Foundation for Credit Counseling (NFCC).

3. Avoid Making It Worse

Stop using credit cards to cover expenses. Cut discretionary spending, sell unused items, or consider a temporary side gig to generate extra cash.

Also Read: What Does Market Cap Mean in Investing?

📚 Expert Insight: The Emotional Side of Money

Personal finance isn’t just about math — it’s about behavior and mindset.

Financial author Dave Ramsey emphasizes emotional wins: “You can’t outsmart bad behavior with math.” Meanwhile, investor Warren Buffett takes the rational view — maximize returns while managing risk.

The truth? You can blend both philosophies.

If paying off debt makes you feel lighter and more in control, that’s a valuable return too — even if it’s not the most mathematically optimal move.

🧠 Key Takeaways

- High-interest debt first: Always eliminate credit cards and payday loans before investing.

- Low-interest debt? Investing might outperform it long term.

- Balance matters: You can pay debt and invest at the same time.

- Mental health counts: Peace of mind is worth money, too.

- Start early: Whether investing or paying off debt — time is your greatest ally.

Final Thoughts

There’s no universal answer to whether you should pay off debt or invest first.

The best choice depends on your personal situation — interest rates, goals, risk tolerance, and emotional comfort.

- If your debt carries high interest (8%+), prioritize paying it off.

- If it’s low-interest, consider investing to build long-term wealth.

- Or do both: pay down bad debt while investing steadily for the future.

Whatever path you choose, the key is to stay consistent and make your money work for you, not against you.

Frequently Asked Questions

Q1. Should I invest if I still have student loans?

Yes, especially if your loans have a low interest rate (<6%) and you can contribute to a 401(k) or IRA with tax benefits.

Q2. Is it ever bad to pay off a mortgage early?

Not necessarily, but if your rate is low and you can invest elsewhere for higher returns, it may not be the best use of cash.

Q3. Should I build an emergency fund before investing?

Absolutely. Have at least 3–6 months of expenses saved in a liquid account first.

Q4. What’s the best way to start investing while paying debt?

Use automatic transfers to a retirement account or robo-advisor. Even small, consistent contributions build momentum.

Q5. Can paying off debt too early hurt my credit?

Not really — but closing old credit card accounts can slightly lower your score due to reduced credit history.