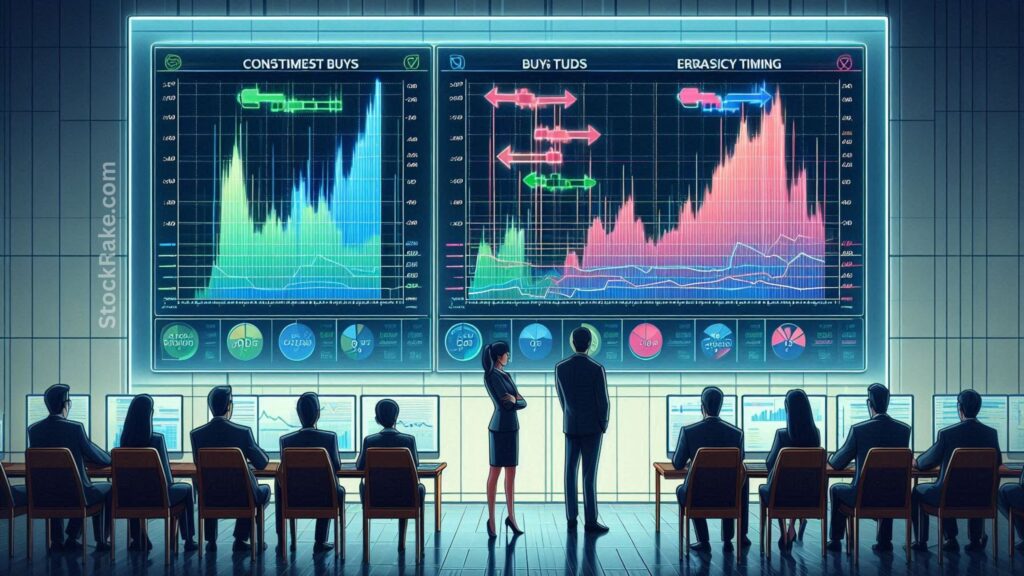

Investing can feel overwhelming, even for people who’ve been doing it for years. Trying to “time the market” — buying when prices are low and selling when they’re high — sounds great in theory, but it rarely works out perfectly.

That’s where dollar-cost averaging (DCA) comes in. It’s a smart, steady strategy that takes the stress out of deciding when to invest. Instead of guessing the perfect time to buy, you just invest the same amount of money at regular intervals — whether prices are up or down. It keeps you consistent and removes the guesswork.

So, What Is Dollar-Cost Averaging?

It’s pretty simple:

With DCA, you invest a fixed amount — say $100 — into a particular investment (like a stock, mutual fund, or ETF) at regular time intervals — weekly, biweekly, or monthly. You do this no matter what the price is.

When prices are low, your money buys more shares. When prices are high, it buys fewer. Over time, this helps reduce the average cost per share and smooths out the ups and downs of the market.

This approach helps you avoid the risky game of trying to time your investments perfectly.

DCA is also known as the “constant dollar plan.”

How Does It Work in Real Life?

Let’s say you contribute to a 401(k) at work. That’s a real-life example of dollar-cost averaging. Each paycheck, a portion of your salary automatically goes into your retirement account and buys your chosen investments — regardless of what the market is doing.

You can also use DCA outside of a 401(k). For example, you might:

- Set up automatic investments in a Roth or traditional IRA

- Buy mutual funds or index funds in a brokerage account

- Use DCA to invest in ETFs or dividend-paying stocks through DRIPs (dividend reinvestment plans)

Also Read: What Are the Best Renewable Energy Stocks to Watch?

Why DCA Is a Great Strategy

Here are some reasons people love dollar-cost averaging:

- ✅ Reduces risk: You don’t have to worry about buying at the wrong time.

- ✅ Builds good habits: Investing regularly helps you grow your wealth over time.

- ✅ Takes emotions out of investing: No more stressing about market ups and downs.

- ✅ Works automatically: Set it and forget it — your plan runs on autopilot.

- ✅ Keeps you in the market: You’re already buying when prices dip, so you don’t miss out.

Who Should Use Dollar-Cost Averaging?

Dollar-cost averaging works for just about anyone — especially if:

- You’re new to investing and unsure when to buy.

- You want to invest regularly without overthinking it.

- You don’t have time (or desire) to follow the market every day.

- You’re focused on long-term investing, not quick gains.

But keep in mind:

If the price of an investment goes up steadily over time, DCA might result in buying fewer shares than if you had invested a lump sum early on. And if prices keep falling, you might continue buying when it would have been better to wait.

Also, DCA works best with diversified investments like index funds, not with individual stocks you haven’t researched.

Let’s Look at an Example

Joe works at ABC Corp and earns $1,000 every two weeks. He decides to invest 10% of each paycheck — that’s $100 — into his 401(k) plan.

He splits that money equally between a large-cap mutual fund and an S&P 500 index fund — $50 each.

Over 10 pay periods, Joe invests $500 into the index fund. The share price goes up and down during that time, so he ends up buying more shares when the price is low and fewer when it’s high.

Here’s what happened:

- Joe bought 47.71 shares for $500.

- His average price per share was $10.48.

If Joe had instead invested the full $500 in one go (say, during pay period 4 when the price was $11 per share), he would’ve bought only 45.45 shares.

So with DCA, he got more shares at a lower average price — all without trying to time the market.

Also Read: What Are the Key Takeaways from the Latest Fed Meeting?

How Can You Use This Strategy?

If there’s a stock or fund you want to invest in but you’re not sure when to start — just start small with dollar-cost averaging. You can:

- Set up automatic investments weekly or monthly.

- Stick to a fixed amount you’re comfortable with.

- Ignore short-term market noise and stay focused on the long run.

Whether it’s through your 401(k), IRA, or brokerage account, dollar-cost averaging is a smart, steady way to grow your investments — without the pressure of picking the “perfect” time.