Maybe—maybe not. It really depends on your personal situation. Many financial experts recommend rebalancing your portfolio every 6 to 12 months. If you’re working with a financial advisor, they can help guide you through the process to make sure your investments still match your goals.

If you’re managing your own portfolio, rebalancing can seem a bit tricky. But don’t worry—there are tools and investment products that can make it easier. You can also check out our Beginner’s Guide to Asset Allocation, Diversification, and Rebalancing for a simple breakdown of the basics.

Have Your Goals Changed?

Before you make any changes, ask yourself: Have my financial goals changed?

Are you still saving for a home? Your child’s college? Planning to retire at 65? Life events like these should factor into your decision. It’s also a good time to think about whether your risk tolerance or your investment timeline has shifted.

Your Investment Mix Will Likely Change With Age

It’s no secret: the earlier you start saving for retirement, the better. But as you get older, your investment strategy usually needs to change too.

When you’re younger, you generally take more risks—putting more money into stocks. Why? Because you have time to bounce back from any losses. But as you get closer to retirement, it makes sense to play it safer with more stable investments like bonds, CDs, or even cash.

Here’s a simple example:

- In your 20s, you might have 80% stocks and 20% bonds.

- As you near retirement, you may shift to 60% stocks and 40% bonds.

- In retirement, you might go even more conservative—maybe 30–50% stocks and 50–70% bonds to help generate income.

These numbers aren’t one-size-fits-all, but they give you a general idea of how your portfolio can shift over time.

Also Read: Is a Market Correction Coming? What Analysts Are Saying

Prefer a Hands-Off Approach? Try “Set It and Forget It”

If you’d rather not worry about rebalancing yourself, you could look into target-date funds or lifecycle funds. These are mutual funds that automatically adjust your mix of investments as you get closer to retirement.

They usually start with a higher percentage of stocks, then gradually shift toward bonds, CDs, and other safer options as your target retirement date approaches. All you need to do is pick a fund that matches your retirement year, and the fund managers handle the rest. It’s a simple, hands-off strategy that can take a lot of the stress out of investing.

Should You Change Your Portfolio During Market Volatility?

When markets are shaky, it can be tempting to make big changes. But before you do anything drastic, take a breath. Trying to “time the market” by jumping in and out can be risky. If you sell your stocks while the market is down, you might lock in losses and miss the rebound.

Instead of going “all in” or “all out,” think about making small adjustments. For example, if your stock portion has grown too large, you could reduce it slightly and shift that money into other assets like bonds or cash.

Sometimes, one part of your portfolio grows faster than others. That throws your original balance off. Rebalancing helps you get things back in line.

Also Read: How to Build a Winning Trading Plan from Scratch

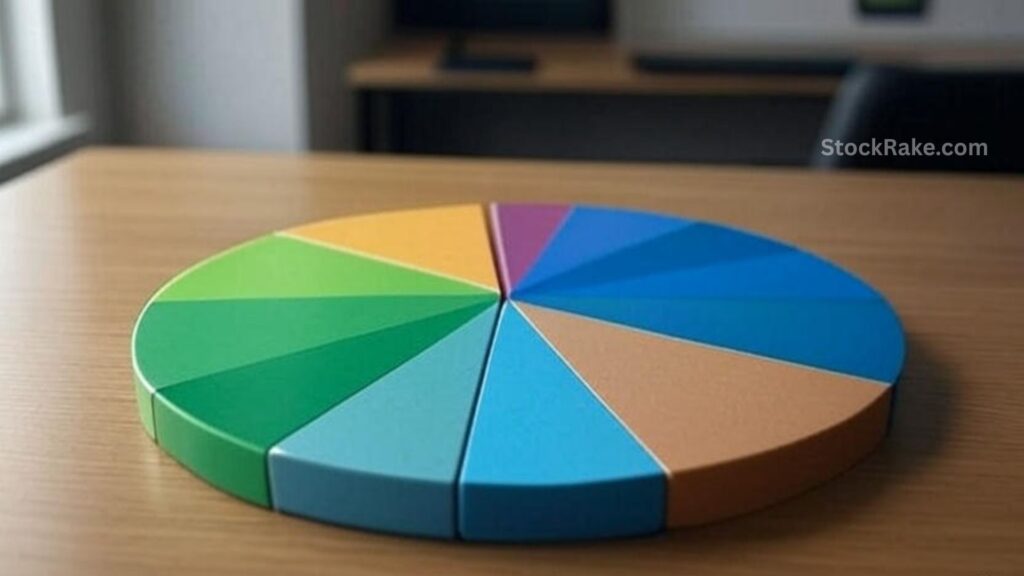

Don’t Forget Diversification

Diversifying your portfolio is a key part of long-term investing success. This means spreading your money not just across different types of assets—like stocks and bonds—but also across different sectors or industries.

Ask yourself: Am I too heavily invested in one area that hasn’t performed well? It might make sense to shift things around.

And here’s something that may surprise you—you might want to sell some of your winning investments and buy more of the underperforming ones. Why? Because “buy low, sell high” still holds true. Different types of assets do well at different times.

A Quick Example of Rebalancing

Let’s say your original portfolio was 80% stocks and 20% bonds. After a year, stocks have done really well, and now your portfolio is 85% stocks and only 15% bonds.

To get back to your original mix, you could sell 5% of your stocks and use that money to buy more bonds. That’s what rebalancing looks like in action.

Before you make any changes, though, check for fees or possible tax consequences. Selling investments can sometimes lead to unexpected costs, so make sure it’s worth it.

And remember—sometimes, the best move is to leave your portfolio alone.

Also Read: How Do You Set Financial Goals That Actually Work?

Don’t Overthink It

Yes, it’s smart to check in on your portfolio from time to time. But don’t obsess over every little change. Focus on your long-term goals and avoid making big moves based on short-term market swings.

Rebalancing is all about staying aligned with your goals—not chasing every market trend. Keep calm, stay consistent, and make adjustments when they truly make sense.