The stock market… well, it never really sleeps, does it? Prices are constantly jumping up and down, reacting to literally everything — company results, global news, rumors, tweets… you name it. For a lot of people, that’s just chaos. Too much to follow. But for swing traders, it’s kind of like candy. All those ups and downs? That’s where the money is.

Swing trading is basically trying to profit from short- to medium-term price moves. We’re talking trades that last a few days to a few weeks — not crazy day trading where you’re staring at screens for hours, and not long-term investing where you barely touch your stocks for years. Swing trading sits in the middle. It’s active, but not exhausting.

If you’re curious whether this is something you could actually do without losing your mind, this guide is gonna walk you through it all. How it works, strategies, the good and bad, and even a little example to make it real.

💡 What is a Swing?

A “swing” in trading is basically the movement of a stock price from one point to another. That’s it. Nothing fancy.

- Upward Swing: Price goes from low to high.

- Downward Swing: Price drops from high to low.

Swing traders are just trying to catch these waves. Buy near the bottom, sell near the top, or if you’re shorting, sell high and cover low. Picture it like surfing. You’re not trying to ride every single wave, just the ones that look promising.

So yeah, it’s less about obsessively watching the market and more about spotting patterns and jumping in at the right moment.

Also Read: Is Dollar-Cost Averaging Still a Smart Strategy in 2025?

📈 What Is Swing Trading?

Swing trading is really just taking advantage of short-term trends. Unlike day trading, you don’t have to open and close every trade in one day. Swing traders hold onto their positions for a few days, maybe even weeks, depending on how the market moves.

The goal? Ride a swing — a price move within a bigger trend — and get out before it flips the other way. It’s not about hitting the jackpot every time; it’s about catching several good swings over time.

Think of it as… “okay, this stock is moving nicely in my direction, let’s ride it a bit before it turns.” That’s the mindset.

🧩 How Swing Trading Works

Here’s how most people approach it, step by step:

- Spot Trends

First thing is figuring out if the stock is trending up or down. Moving averages, trendlines, and simple charts usually do the trick. - Plan Your Entry & Exit

Decide where you’ll buy and sell before jumping in. Look at patterns, key levels, or volume changes. Don’t wing it. - Set Stop-Loss Orders

This is your safety net. If the stock goes against you, the stop-loss will sell automatically. Saves a lot of heartache. - Monitor the Market

You don’t have to be glued to the screen. A quick daily check or a few times a week is enough. But stay alert — things can change fast.

Pro tip: Tools like TradingView or Zerodha Kite are lifesavers. You can see trends, set alerts, and manage your trades without losing your mind.

Also Read: What Is a Stock and How Does It Work?

🔍 Top Swing Trading Strategies (Perfect for Indian Markets)

Swing trading isn’t “one size fits all.” Some strategies fit some people better, and some stocks better. Here’s a bunch that Indian traders use a lot:

1. Trend Following

This is about hopping on the trend that’s already there — up or down. Don’t try to fight it.

How to Use It:

- Buy during a small dip in an uptrend.

- Buy when price breaks above resistance.

- Moving averages (20-day or 50-day) can confirm the trend.

Example: Tata Motors has been climbing steadily. There’s a small pullback — that’s probably your entry point. Easy.

2. Support and Resistance Trading

Stocks often bounce at certain price levels (support) or stall at others (resistance). If you notice them, you can plan your trades better.

How to Use It:

- Buy near strong support.

- Sell near resistance.

Example: If a stock keeps bouncing at ₹500, buy near that. If it struggles to break ₹1,000, maybe sell there.

Pro tip: Double tops or double bottoms usually hint that the trend might reverse soon. Keep an eye out.

3. Momentum Trading

Momentum traders chase speed. The stock moves fast, backed by heavy volume, and they ride it.

How to Use It:

- RSI or Stochastic Oscillator can help spot momentum.

- Buy when momentum builds.

- Exit when momentum fades.

Example: A stock surges with high volume and RSI goes from 45 to 65 — that’s a clear buying signal.

4. Breakout Trading

Breakouts happen when price escapes a key level — up or down — usually with big volume.

How to Use It:

- Spot previous highs and lows.

- Confirm the breakout with volume.

- Avoid fakeouts — wait for the candle to close past resistance.

Example: Infosys breaks ₹1,600 after failing a few times, and volume spikes. That’s usually a strong signal to buy.

5. Reversal Trading

Sometimes a trend flips — that’s where reversals come in.

How to Use It:

- Indicators like MACD and RSI divergences can hint at reversals.

- Enter when momentum starts changing direction.

Example: HDFC Bank falls for days, but RSI starts rising while the price is still going down — could be a bullish reversal coming.

6. Consolidation and Breakouts

Stocks sometimes just sit in a tight range — this is consolidation. Eventually, they break out in one direction.

How to Use It:

- Look for triangles, wedges, or cup-and-handle patterns.

- Buy once the stock breaks above the range.

Example: A stock trades between ₹450–₹500 for weeks, then breaks past ₹500 — that’s usually the start of a new trend.

Also Read: What’s the Difference Between Stocks and ETFs?

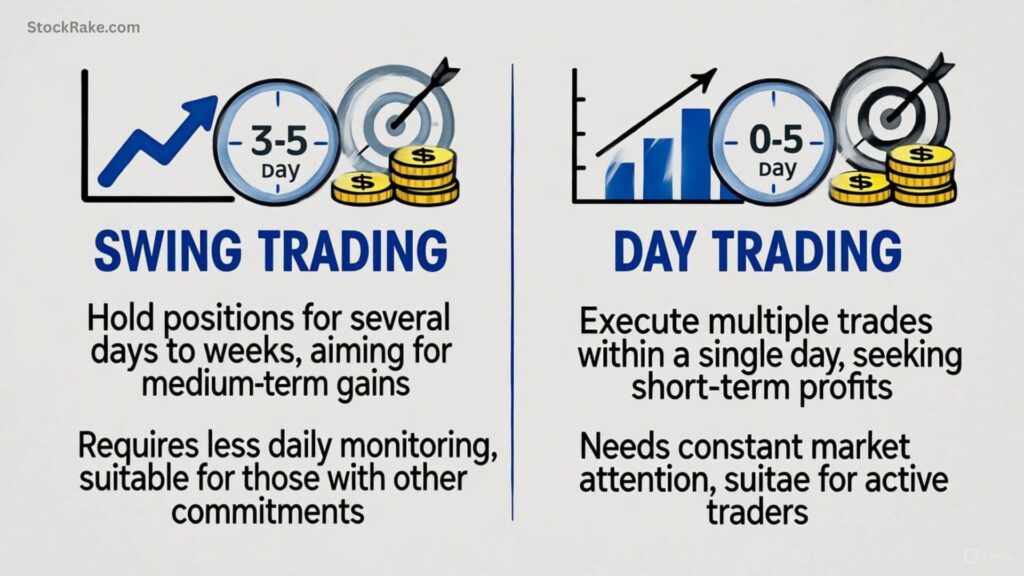

🆚 Swing Trading vs. Day Trading

| Aspect | Swing Trading | Day Trading |

|---|---|---|

| Time Frame | Days to weeks | Same day |

| Screen Time | Few hours weekly | Constant |

| Stress Level | Moderate | High |

| Capital Needs | Medium | High (margin) |

| Risk Level | Moderate | High |

| Suitable For | Part-time traders | Full-time traders |

Quick tip: If you have a day job or just don’t want to live on charts, swing trading is probably better.

🆚 Swing Trading vs. Long-Term Investing

| Aspect | Swing Trading | Long-Term Investing |

|---|---|---|

| Duration | Days to weeks | Months to years |

| Focus | Charts & patterns | Company fundamentals |

| Risk | Short-term volatility | Market cycles |

| Returns | Frequent, smaller profits | Compounded gains over time |

Many people do both: invest in big blue-chip stocks for long-term stability, and swing trade mid-caps or trending stocks for faster gains.

📊 Must-Know Swing Trading Patterns

Patterns are like little hints about what the market might do next:

| Pattern | Type | Meaning |

|---|---|---|

| Head and Shoulders | Reversal | Trend might be ending |

| Double Top / Bottom | Reversal | Strong support/resistance zones |

| Cup and Handle | Continuation | Usually bullish before breakout |

| Flags & Pennants | Continuation | Short pause before trend resumes |

| Triangles | Neutral | Direction confirmed after breakout |

They’re clues, not guarantees. Always confirm with volume or other indicators.

✅ Pros of Swing Trading

- Flexible schedule — don’t need to stare at charts all day.

- Good profit potential — small wins can compound.

- Less emotional stress than day trading.

- Can hold multiple trades at once.

❌ Cons of Swing Trading

- Overnight risk — news can gap prices.

- Needs discipline — impulsive trades will burn you.

- Capital exposure — trades last longer, bigger swings.

- False signals — sometimes indicators lie.

💬 Real-World Example: Swing Trading in Action

Say Infosys (INFY) forms a bullish flag on the daily chart.

- You enter at ₹1,550 after breakout.

- Stop-loss at ₹1,500.

- Two weeks later, it hits ₹1,670.

Profit? Around 7.7%. Easy-ish swing trade, limited effort.

🧠 Expert Tips for Successful Swing Trading

- Keep a trading journal — write down trades, outcomes, emotions.

- Combine charts with fundamentals — strong companies reduce risk.

- Keep risk below 2% per trade. Protect your capital.

- Don’t overtrade — pick quality setups.

- Stay updated — Bloomberg, Moneycontrol, Economic Times… even just headlines help.

Conclusion: Is Swing Trading Right for You?

Swing trading sits between long-term investing and day trading. Fast enough to be interesting, flexible enough for normal life.

If you like spotting patterns, analyzing charts, and managing trades over days or weeks, it could be your thing. Start small, paper trade if needed, refine your strategy over time.

First step: Pick one stock, mark support and resistance levels, and try a paper trade. Learn before putting real money in.

❓ Frequently Asked Questions (FAQs)

Q1. Is swing trading good for beginners?

Yes. Less stressful than day trading, plenty to learn, good starting point.

Q2. How much capital do I need to start swing trading?

Even ₹10,000–₹25,000 can work. Focus on learning first, money second.

Q3. Which indicators are best for swing trading?

20/50 EMA, RSI, MACD, volume analysis.

Q4. Is swing trading risky?

Yes. But stop-losses and discipline control risk.

Q5. How long should I hold a swing trade?

Usually 3 days to 3 weeks, depends on strategy and market.